Article • 4 min read

Can chatbots make the insurance industry more human?

Dan Levy

Content Marketing and Editorial Strategy

This was originally published on the Smooch blog. You can learn more about Zendesk acquiring Smooch here.

When you think insurance, you probably don’t think digital innovation.

For most of us, shopping for home or car insurance is a tedious process, filled with never-ending forms, repetitive phone calls and a nagging sense that things could be a lot simpler.

But a new generation of insurance industry professionals are trying to change that, with a little help from a chatbot.

For the past two years, a Canadian startup called ProNavigator has been building an AI-powered “conversation engine” to make the experience of buying insurance “faster and more convenient,” as co-founder and CEO Joseph D’Souza put it.

Thanks to ProNavigator, whose bots are deployed on its customers’ websites and chat apps via Sunshine Conversations, forward-looking insurance companies and brokers are generating more leads, engaging more customers, and finally bringing the insurance industry into the 21st century.

A changing industry

Like most industries, the insurance space is going through a “massive change” right now, explains Joseph. A new breed of “InsureTech” startups like Lemonade and Trov are putting legacy companies on alert.

Want to learn more about conversational business, chatbots, and customer experience?

Insurance companies realize they need to adopt new technology to attract the next generation of customers, while brokerages are struggling to stay relevant and not get cut out of the deal. ProNavigator is building its bots for both sides of the equation and has signed almost 70 customers across the U.S. and Canada. Embedding a chatbot on their websites allows brokers and insurers to respond to the roughly 30 percent of conversations that take place outside of work hours, according to Joseph. It’s also helping them transform customer experience.

From forms to conversations

Most insurers and brokers today have a “quoting engine” on their websites. These are long, multi-step web forms that collect a bunch of information from the user in exchange for a quote, which is usually delivered by email. Often, the business follows up with a phone call. This experience is far from optimal, for both customers and businesses.

“Nobody wants to fill out a web form just to wait for someone to get back to them,” says Joseph. ProNavigator takes that experience and translates it to a conversational interface. This allows customers to ask clarifying questions along the way, such as, ‘Hey, do I put down the zip code for my business or my home?’ or ‘What if I occasionally use my car for work?’

“We can say, okay, the user’s not understanding, let me answer the question and then, more importantly, bring them back to where they left off and let them complete the quote,” says Joseph.

ProNavigator also allows for bot-human handoff, meaning real brokers or insurance agents can jump into the chat if the bot is stuck or the end user requests assistance.

With traditional quoting engines, less than 50% of users (sometimes as low as 10%) complete the flow and submit their email, according to Joseph. ProNavigator is seeing an average form completion rate of 78% with its system, meaning some brokers are generating almost 30% more leads by embedding a chatbot on their website.

“The minute a customer lands on the site we engage them through chat,” explains Joseph. “That’s a much more powerful experience.”

Bots as brokers

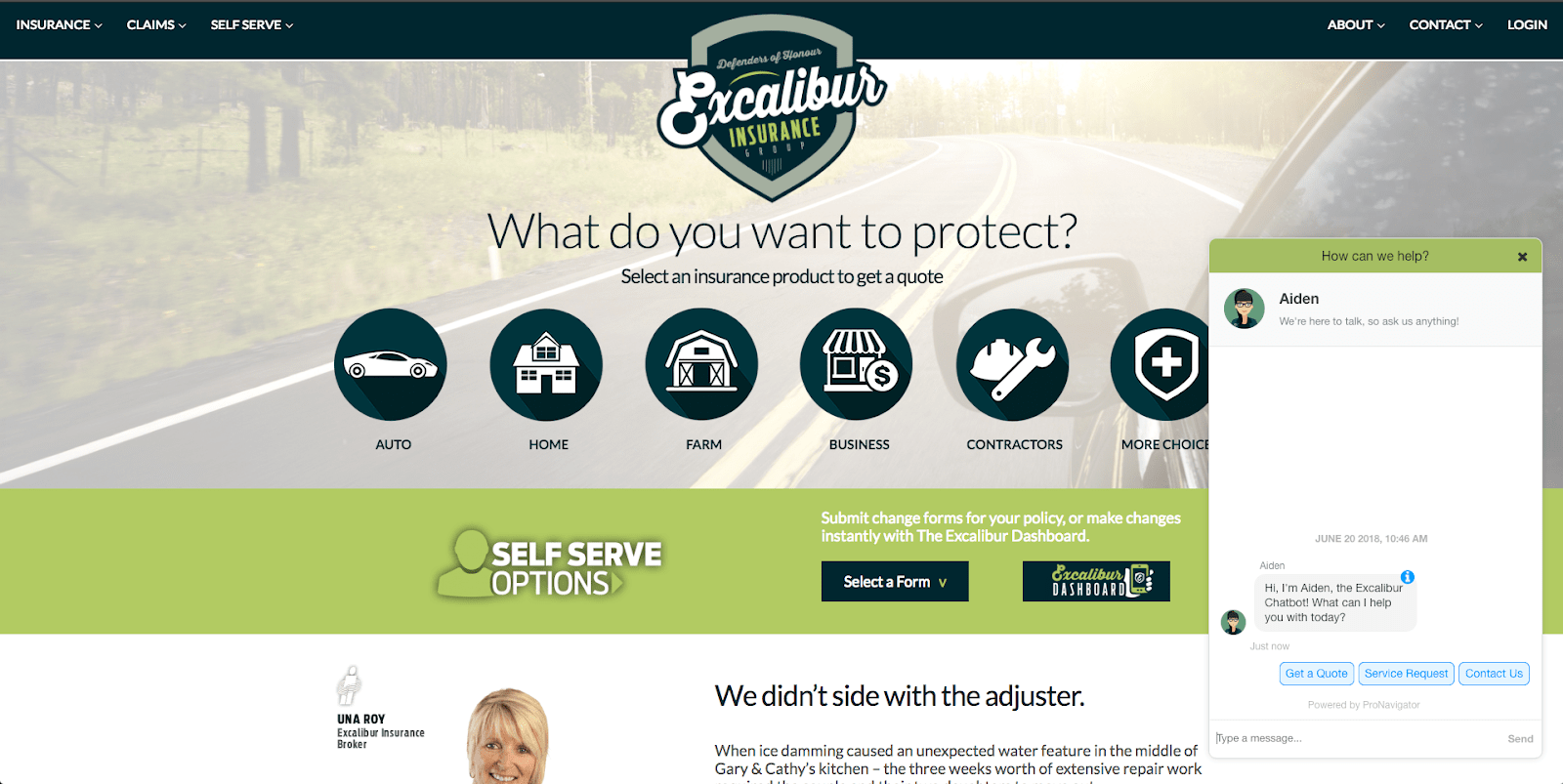

Excalibur Insurance is a digital brokerage whose CEO, Jeff Roy, describes himself as “a Millennial trapped in a Gen X body.”

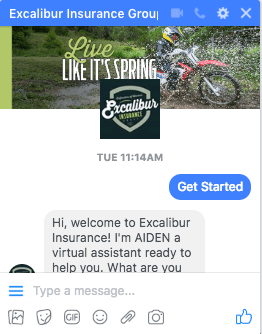

Excalibur uses a ProNavigator-powered chatbot named Aiden to generate leads, serve customers and “stay ahead of the curve,” says Jeff.

Aiden is featured on Excalibur’s Twitter feed, where customers are encouraged to chat on their website and through Google Voice. You can ask Aiden questions like, “What’s the most expensive set of teeth ever insured?” or “What’s the highest speed ever recorded on a motorcycle?”

Jeff thinks chat will transform the industry as soon as major insurance companies allow brokers to access their APIs and sell insurance directly online. For now, Aiden can provide a quote but a human broker has to follow up to close the deal.

“My chatbot would become like another broker but would always answer the right question, not get distracted, record everything, and talk to 15 companies at once,” imagines Jeff. “The sky’s the limit.”

Making technology more human

The ProNavigator team is busy honing their AI and natural language processing engine, building more voice integrations and “working alongside the customer support agents using the tools we’ve built” to understand how to make them better, says Joseph.

So far they’ve been surprised to see people interacting with bots in an unmistakably human way — even thanking them for their help at the end of a conversation.

“When’s the last time you thanked an app on your phone for showing you the weather or Microsoft Word for sharing a document?” says Joseph. “By humanizing technology we have this golden opportunity to reimagine how we interact with machines.”